Understanding Emergency Cash Loans

Emergency money loans are a sort of short-term borrowing designed to help individuals deal with pressing monetary needs.

Understanding Emergency Cash Loans

Emergency Fund Loan money loans are a sort of short-term borrowing designed to help individuals deal with pressing monetary needs. Unlike conventional loans, which can take weeks to process, these loans typically offer a faster turnaround. This pace is crucial during emergencies when people cannot afford to attend for a prolonged approval course

On the opposite hand, responsible borrowing can facilitate entry to greater training, often leading to higher job alternatives and incomes potential sooner or later. Therefore, it’s necessary for students to strike a stability between buying needed funds and maintaining manageable debt ran

What Are Credit Builder Loans?

Credit builder loans are specially designed to assist individuals set up or improve their credit score scores. Unlike traditional loans, these loans usually do not require a credit score verify for approval, making them accessible to those with limited or poor credit score historical past. When you're taking out a credit score builder

24-Hour Loan, the lender locations the borrowed quantity right into a secured account. Throughout the compensation period, you make common funds, which are reported to major credit score bure

Once an appropriate lender is selected, applicants usually fill out a web-based application type, offering essential personal info corresponding to income, employment standing, and banking particulars. Many lenders require minimal documentation, making the method sooner and extra conveni

The Application Process Explained

The process of applying for student loans on-line typically entails a quantity of simple steps. First, students ought to gather needed documentation, similar to proof of earnings, tax returns, and identification. Once prepared, they will go to lender web sites or comparability platforms that listing multiple opti

As comfort drives more folks to discover on-line lending options, understanding the mechanics of those loans turns into paramount. Borrowers should familiarize themselves with interest rates, repayment terms, and the general cost of borrowing to make informed selecti

Students will fill out an online utility kind, which typically requests personal information, financial particulars, and academic background. After submission, lenders will consider the application based mostly on creditworthiness and different factors. This evaluation can vary in period, however many lenders provide a decision within a couple of hours to a few d

How to Apply for Instant Loans Online

Applying for immediate loans on-line is a

straightforward course of that usually involves a quantity of key steps. Firstly, potential debtors should research numerous lenders and understand their choices, together with rates of interest and the phrases of the l

To improve approval probabilities, borrowers should ensure their credit score stories are in good condition. This entails paying down debt, making funds on time, and minimizing new credit score purposes. Additionally, having a cosigner can bolster your application and should help in securing higher ra

Yes, credit builder loans are particularly designed for individuals with limited or poor credit histories. Most lenders do not require a credit score examine, making these loans accessible to a variety of debtors. This alternative permits people to improve their credit scores and achieve access to raised financial merchandise in the fut

Challenges and Risks

While there are tons of advantages to quick online loans, they also come with dangers. One of probably the most important challenges is the upper rates of interest related to loans for poor credit. Borrowers may find themselves paying considerably greater than they'd if that they had better credit score scores. It is essential to rigorously learn the terms and conditions earlier than agreeing to any mortgage. Understanding the entire value of borrowing can prevent future financial press

Understanding Student Loans Online

Student loans online have remodeled how college students access funding for higher schooling. Traditionally, students must go to financial establishments in individual, which could be time-consuming and inconvenient. Now, with a few clicks, college students can explore various mortgage choices from multiple lenders with out leaving their homes. This comfort is simply one of many advantages of on-line scholar lo

Moreover, BePick takes delight in providing academic content, including weblog articles, how-to guides, and FAQs that demystify the borrowing process for school kids. This dedication to empowering debtors contributes to knowledgeable decision-making in their academic financing jour

Students should also familiarize themselves with mortgage repayment options similar to income-driven repayment plans and mortgage forgiveness packages, which can present important reduction as they navigate their post-educational pathw

63 Apartment Amenities to Add to Your List

63 Apartment Amenities to Add to Your List

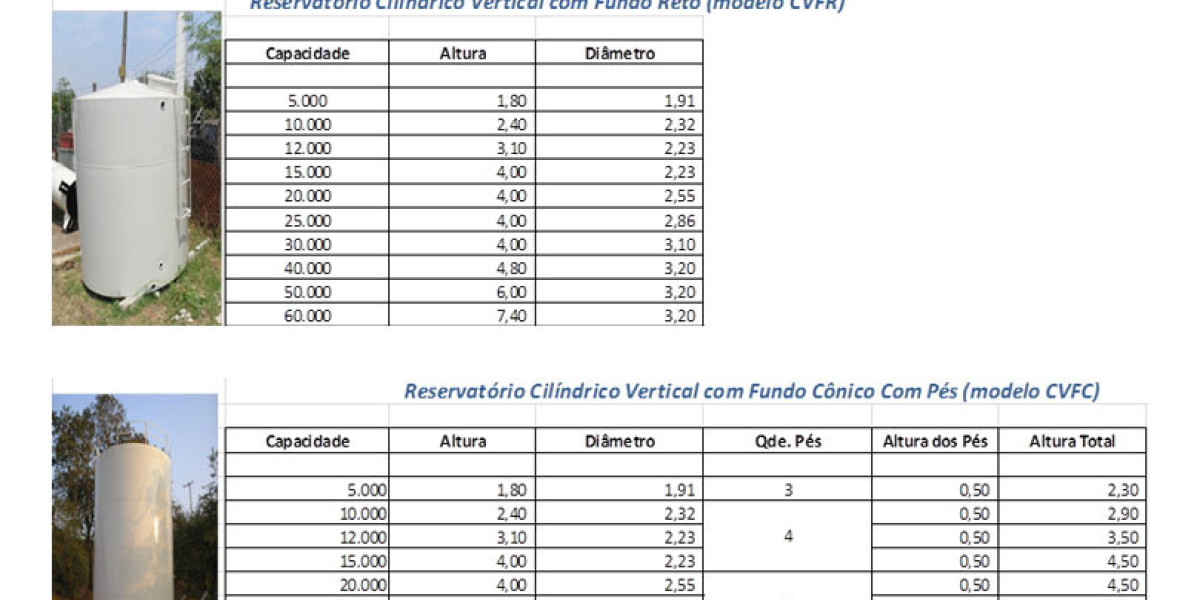

Corrugated Tanks, Corrugated Water Tanks, Galvanized Water Tanks, Steel Water Tanks

Corrugated Tanks, Corrugated Water Tanks, Galvanized Water Tanks, Steel Water Tanks

5 Laws That Anyone Working In Address Collection Should Know

By jujojula5767

5 Laws That Anyone Working In Address Collection Should Know

By jujojula5767 Local Plumbers in Ashburn VA Top-Rated Plumbing Services

Local Plumbers in Ashburn VA Top-Rated Plumbing Services

American Airlines introduce new amenity kit bags

American Airlines introduce new amenity kit bags